Rootnet Customer Relationship Management (CRM) is a must for banks interested in exceeding customer expectations by offering service with personalized and customer-centric strategies. The benefits of Rootnet CRM can be as mechanical as storing relevant information about customers or sending personalized emails, to more intelligent actions such as managing leads and analyzing customer behavior with each marketing campaign.

When it comes to banking and finance, our Rootnet Intranet is essential to facilitate communication and collaboration between staff or departments, reinforcing company culture and the ability to work as a team. An Intranet solution is also recommended as it can be customized to address the fact that not all financial institutions have the same performance or requirements.

Rootnet's Service Desk automates repetitive tasks within the banking industry by digitizing the customer experience and sectors such as investment banking, corporate, private equity, among others. By carrying out and verifying calculations, completing forms and searching and extracting data from the web, databases and folders, the Service Desk helps the banking industry operate more productively and efficiently, as more time can be spent in providing more personalized attention to the sectors that generate the most money for the bank.

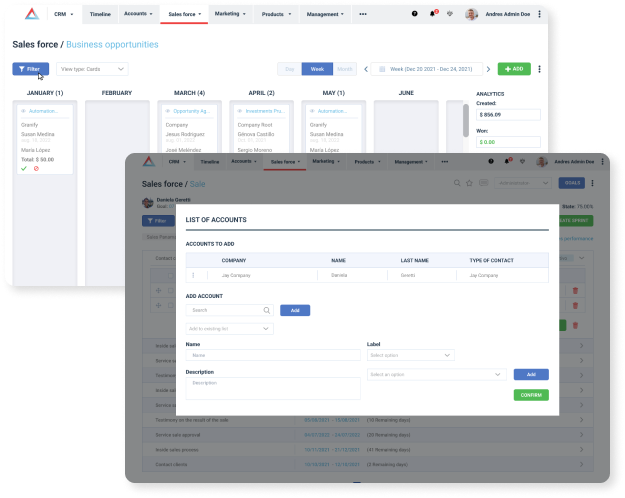

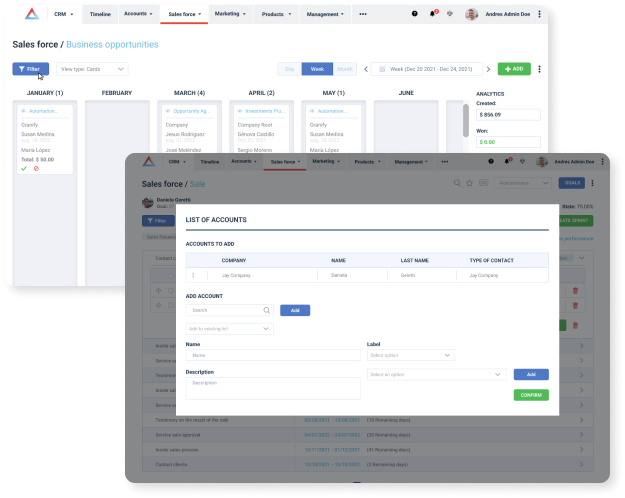

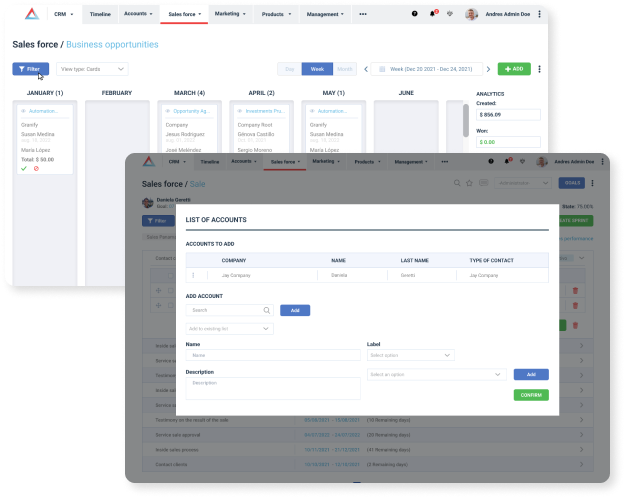

Automating your flows has never been so fast and easy

Using a mobile application, businesses will be able to create opportunities and see the commercial penetration effort in the market.

Customer service is centralized, even with multiple channels such as mobile banking, online banking, self-management and branches.

Standardizing profiles and roles in various bank branches improves Human Resources management, optimizes operations and increases productivity by clearly defining positions and allowing fluid changes.

Single sign-on can be applied to all banking solutions, adapting the solution to evolve according to needs